There are 4 key things to implement when building your wealth.

And, we will show you the connection between building your wealth and having great health.

There is a hands down connection between building great wealth and having excellent health, and behind the scenes there is a genuine reverse gift that ultimately transforms into, health being your wealth. They are powerfully interconnected and both are fundamental opportunities for you to achieve and fulfill an incredible life.

Health is wealth and vice versa.

With the stress we put on our lives whether it be conscious or unconscious stress, it is not only slowly destroying our health but also destroying our wealth. Both are potent forces and getting on top of them will help us not only survive but thrive in our precious lifetime.

Here are the 4 Keys to building your wealth

#1. A CLEAR PLAN

Knowing your WHY for building your wealth and having a plan built around it is the first key.

The power of purpose (your why for building your wealth) is a compelling ingredient for success. Socrates, Plato and Aristotle talked about this. ‘He who has the why to live can bear any how.’

Knowing your why begins a behavior change that focuses you upon what needs to be done. The clearer you are on why you want to build your wealth and having clear steps to getting there is what you need to drive ahead without getting distracted. Those BSO’s are the things that derail us throughout life and take us away from our ultimate goal/s.

Once you are clear, your clarity and dogged focus become the very powerful internal drivers where you overcome challenges with a sense of enjoyment and satisfaction. That self pride derived from staying on track while building your wealth through all the challenges propels you further to achieve more.

This is why you must first find, and be clear on your WHY for building your wealth. These focus and clarity attributes also build physical and mental health and strength in the same way. Preparation meeting opportunity!

#2. THE RIGHT STRATEGIES

The habit of saving and investing in appreciating assets for building your wealth

💡 We are what we repeatedly do.

Excellence and success then, is not an act, but a habit. As is wealth building and health building. And, the habit of positive self-talk in the form of a powerful and supportive mind, changes what happens in your life. These habits are energizing and open the floodgates for sustained endurance for building your wealth to accelerate your vision into reality.

💡 Comfort is a slow death when building your wealth

Being comfortable doesn’t help us, some stress is good for us. When we stretch ourselves and embrace the pressure that inevitably builds at times throughout our life, it also builds strength, physically, mentally and emotionally, and as you stretch more, the stronger you get, the more resilient you become, and in turn, the more resilient to the stress you become.

– Clarity is the map and slow repetition builds strong foundations, greater resilience and speeds up your success at building your wealth, both initially and overtime.

Physical stress is good for us, mental stress is bad.

And long-term chronic stress has a negative impact on your physical and mental health. Life becomes hard and even distressing. There is a clear link between physical and mental conditions. Wealth stress affects people to the point of burnout or worse. 😔

Hold up, here is the good news….

Metabolize your wealth for your health’s sake.

Incorporating both physical and financial exercise into your daily life can mobilize your metabolism and pay huge dividends to your physical and financial health.

Buddha said, ‘To keep the body in good health is a duty… otherwise we shall not be able to keep our mind strong and clear.’

Well, building your wealth is no different. When we are actively growing our wealth, we live in accordance with our most beneficial and perfect genome, and as we see positive results it also improves physical and mental health. They are all intimately interrelated.

- You are probably familiar with the idea that regular physical exercise, as well as, mental balancing exercises (acknowledging perceived positives and negatives by seeing the benefits of both sides) can prevent dis-ease and depression, so can exercising your wealth muscles.

- If you have a Fitbit or Apple Watch or the like, it will tell you how many steps you’ve taken each day. This way you see if you have done enough to contribute to your good health. That is not all that is required. Eating well, drinking plenty of water, not drinking alcohol regularly and so on are all required for good health.

So too, these things are required for good wealth.

The activity of paying yourself first, buying appreciating assets, investing well and not overspending or frivolously spending money on depreciating goods are all required for building your wealth.

How do we fix this?

Just like physical health, being active, getting fit, and building muscle – we also do this as a powerful wealth building strategy. Actively putting money aside by paying yourself first, getting you good with money to have your money work for you and engaging a wealth mentor to coach you into financial fitness, to build your ‘wealth’ muscle for sustained strength and performance is the key.

💰 Save to buy appreciating assets and utilize the law of compounding! *Have your money working for you! Not you working for money for the rest of your life.

If building your wealth and having the right plan is important to you, please contact us. A simple chat may be all it takes to get you started.

#3. YOUR TEAM

Adapting your self talk and getting valuable strategic support to keep you on track.

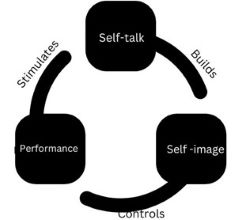

The self-talk loop is another area to build your wealth muscle. What you say to yourself consciously or unconsciously matters and it determines your level of wealth, the quality of your health and your view of the world around you. If you are not conscious of your internal dialogue, your world may seem negative and unfulfilling as opposed to inspiring and fulfilling.

- Everything in life is cyclical. Stock markets, seasons, stages of life, phases of the moon and on it goes. And what you say to yourself can either be a negative cycle or a positive loop. In both cases they will become your self fulfilling prophecies.

- Being focused on your goals, physically and financially and directing your self-talk in a way that serves you, keeps you inspired, and for those times you have negative thoughts and influences creeping in, a chat with your coach, mentor or advisor assists you to keep your eye on the goal and to not get absorbed by the ‘distraction’s that you have allowed into your awareness. Staying focused and on track disrupts the negative self-talk and keeps you centered and concentrated on your goal/s, and what you want most in your life.

You want your self-talk building your self image to control your actions (or performance) which stimulates an even stronger and more positive self-talk. 💡

#4. MINDSET

You are in control

What you can control is your actions, what you say to yourself and how you handle your challenges. Small changes build big outcomes. Make sure they are what YOU want because nobody is going to sort your finances out for you.

There will be great people there to assist and guide you along the way, but they will not do it for you. It’s up to you to build your wealth, as well as, enhance your mental and physical health. And, if you stay in your comfort zone and not stretch, and fail to grow, you will not achieve your true potential and then you will be filled with regrets and disappointment. Yes, harsh maybe, but our choice’s are the results in our life!

And lastly..

ACTION IS YOUR POWER! 💥

You are only as good as your last action, and your actions will be revealed to you by the results you see in your life. Make your actions count in both building your wealth and enhancing your health.

Your commitment is your responsibility, and your success in life depends on your actions and your commitment. So, enjoy the journey, embrace your challenges, live your dreams and be happy, fulfilled, and an inspiration to those left behind. 😃

If you need help with the right plan, strategies, support team and mindset, and this article has inspired you to take action, contact us and allow us to assist you on your wealth building journey.

Call us on 08 7111 0022 – or book a chat here. A simple call may be all it takes to get you started.

Make the rest of your life the best of your life.

Arthur Panagis

Author, Founder, Wealth Coach and Financial Strategist

B.Bus (Accountant)

Grad Dip (Financial Planning)

Professional Certificate in Self Managed Super Funds

ASX Listed Equities Accreditation

Tax (financial) Advisor

<= SHARE THIS STORY

#fmgwealthstrategists #financialplanning #moneytips #moneymanagement #wealthmanagement #financialfreedom #investing #passiveincome #buildingyourwealth

Disclaimer: This article is factual information only. It is not intended to imply any recommendation about any financial product(s) or to constitute tax advice. The information in the article is reliable at the time of distribution, but may not be complete or accurate in the future.

Contact Us

If you want to know more on how to build and protect your wealth contact us here about your financial enquiry today.

Remember, Action is power!

We want to make the rest of your life the best of your life.

Arthur Panagis

Author, Founder, Wealth Coach and Financial Strategist

B.Bus (Accountant)

Grad Dip (Financial Planning)

Professional Certificate in Self Managed Super Funds

ASX Listed Equities Accreditation

Tax (financial) Advisor

👀 You can find out how to start paying yourself first here and start busting down those barriers to building your wealth.

And, if planning your best life is important to you, (or to book a ‘Whole of Wealth’ strategy session), call us on 08 7111 0022 or book online here

Disclaimer: This article is factual information only. It is not intended to imply any recommendation about any financial product(s) or to constitute tax advice. The information in the article is reliable at the time of distribution, but may not be complete or accurate in the future. For information about a loan that may be suitable for you, call us on 7111 0022.

This article is prepared based on general information. It does not take into account individual financial objectives or needs and is not financial product advice.

<= SHARE THIS STORY 🙂