Introducing our INVESTOR GUIDE for successful investing.

Immense uncertainty can make successful investing really difficult at times. Or, so it seems. It is critically important to stay focused on the basic principles of investing, because successful investing can be achieved even through cyclical swings.

Remembering that the basic principles of investing have not changed and while history does not repeat, each cycle is different but each cycle has many common characteristics.

💰 Our Guide to Successful Investing

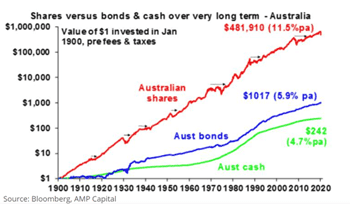

Guide #1. The power of compounding interest for successful investing

Albert Einstein said, “He who understands it, earns it… he who doesn’t… pays it – when it comes to The Law of Compounding Interest.”

What is compound interest?

It is the interest you earn on both the money you’ve saved and the interest you earn on the interest itself. As both forms of interest grow, it begins accumulating more rapidly and in time starts building at an exponential pace.

Key message: While history shows shares have collapsed amidst massive uncertainty shares do well over the long-term.

💰 To grow our wealth and invest successfully, we must have exposure to growth assets like shares and property to have our money compounding and working for us.

Guide #2. Share market cycles

Understanding that periodic setbacks are just an inevitable part of investing and it is important to stay the course to get the benefit of the higher long-term returns that shares and other growth assets like property, provide over time.

You can see over 20 year periods there are no alarm bells ringing but from year to year there can be dramatic shifts in growth and decline.

Key message: When it comes to successful investing, time is on your side and it’s best to invest for the long-term. Short-term volatile swings in the share market are sometimes a fact of life but the longer you hold, the greater the chance your investments will meet your goals.

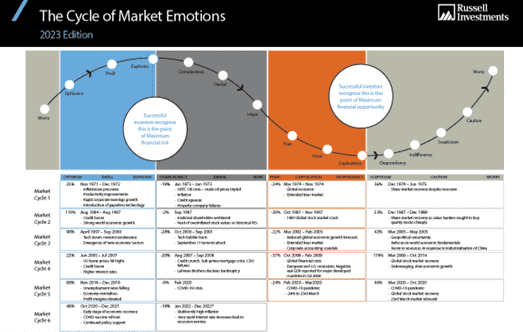

Guide #3. Cycles of investor emotion.

When it comes to investment fundamentals like profits, dividends, rents and interest rates, investor’s emotions can be a rollercoaster if they are not educated and aware of how successful investors roll with the times.

This chart traces the investor emotions through the course of an investment cycle. From euphoria to depression, anxiety to capitulation, managing your emotions plays a huge part in successful investing.

Guess where we are right now!

Key message: Keeping your head in check and having good advice plays a huge role in magnifying or neutralizing the emotional swings the investor may experience during investment market fluctuations. The key for investors is not to get sucked into this emotional roller coaster. Stick to your plan and keep focused on your end goal.

The good news is, that life, like money, property, seasons, the phases of the moon and so on, it is a cycle, and if we know where we are in the cycle we won’t fear it. 💰📈

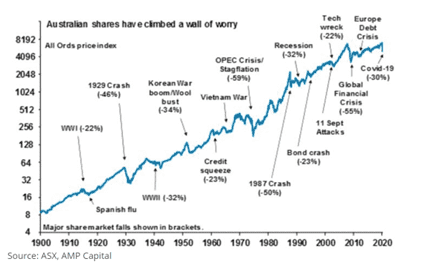

Guide #4. The wall of worry

There is always something for investors to worry about if you let it. You can see in the chart below that the global economy has had plenty of worries over the last century.

But, you can see Australian shares got over them just fine, returning 11.5% per annum since 1900.

Key message: Successful investing allows for the story that worries are normal around the economy and investments and that sometimes it may become a little intense. But like everything in life, that too eventually passes.

Guide #5. Timing the market

To try to anticipate market movements often ends up with you losing valuable traction. The temptation to time the market is sometimes immense but most successful investors know that trying to time the market is very difficult. In fact, Warren Buffett says, “That it is wise for investors to be fearful when others are greedy, and greedy when others are fearful.” Meaning let the market do it’s thing and when the market falls because fearful investors have sold, it’s time to buy. (The right stocks of course – you don’t want to buy rubbish.)

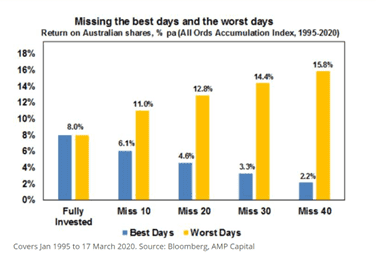

Look at this chart. Those who went in and out of the market for 10, 20, 30 and 40 days had less good days than if they had stayed in the market the whole time.

Key message: Please make a mental picture of this graph so that anytime you are thinking of exiting the market, may you bring this to mind and make a different choice. Trying to time the share market is not easy and successful investing is all about staying the course and taking advantage of the compounding factor over time.

If you need help with the right plan and investment strategies, a support team and a strong financial mindset, contact us – allow us to assist you on your successful investing and wealth building journey.

Call us on 08 7111 0022 or book a chat here – A simple call may be all it takes to get you started.

Make the rest of your life the best of your life.

Arthur Panagis

Author, Founder, Wealth Coach and Financial Strategist

B.Bus (Accountant)

Grad Dip (Financial Planning)

Professional Certificate in Self Managed Super Funds

ASX Listed Equities Accreditation

Tax (financial) Advisor

<= SHARE THIS STORY

#fmgwealthstrategists #financialplanning #moneytips #moneymanagement #wealthmanagement #financialfreedom #investing #passiveincome #successfulinvesting

Disclaimer: This article is general information only. It is not intended to imply any recommendation about any financial advice, product(s) or to constitute tax advice. The information in the article is reliable at the time of distribution, but may not be complete or accurate in the future.