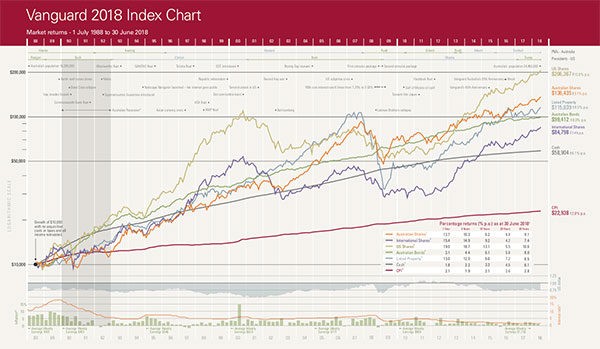

We believe that a successful investments shares strategy starts with an appropriate asset allocation that is most suitable for YOUR objective. The below chart reflects this in Investments and Shares via Vanguard’s latest annual index chart .

One of the key lessons of investing is still taking a long-term perspective. As a result, investing in a range of broad market indices. We have seen over time, this gives investors a greater chance of investing success.

Viewing Investments Shares in Vanguard’s latest annual index chart

EXAMPLE: if you’d invested $10,000 in a single asset class three decades ago, where would you be now?

The ranking of each asset class does vary each year that we review these numbers. While it is tempting to focus on the top performing asset class, it does not provide much more than an interesting fact about a moment in time.

It is difficult for investors to pick out next year’s winners as individual asset classes do have bumpy rides. Given this, markets will often behave differently from each other. Sometimes greatly, sometimes marginally – at any given time.

What does Vanguard’s latest annual index chart tell us?

It’s an interesting question.

When you compare the growth in Investments Shares as shown in Vanguard’s latest annual index chart, investors can expect a smoother ride thanks to a much more diversified portfolio. Individual asset classes to a long-term investment with a balanced diversified fund (50/50 growth/income split) over a 20-year period, maintained a good return on investment in the portfolio.

In practice, diversification is a rigorously tested application of common sense.

You will see this in Vanguard’s latest annual index chart below. US shares performed best, yielding 10.6 per cent. While cash performed worst with just 6.1 per cent.

Okay, are you ready for the numbers?

| $10,000 invested in 1988 | *Accumulated investment value at 30 June 2018 | *Percentage returns per annum |

|---|---|---|

| Australian shares | $136,435 | 9.1% |

| International shares | $84,798 | 7.4% |

| US shares | $206,367 | 10.6% |

| Australian bonds | $99,412 | 8.0% |

| Listed property | $115,839 | 8.5% |

| Cash | $58,904 | 6.1% |

* Provided there were no acquisition costs or taxes and all income was reinvested.

Take a look here.

Want to more about the best investments for your goals and objectives?

Our Perspective on Diversification

The table above shows the performance of various asset classes over the past 30 years.

A QUICK RECAP: Investments Shares in Vanguard’s latest annual index chart

When deciding where to invest your money, it is important investors understand that the best and worst performing asset classes will often vary from one year to the next. As shown in the Investments Shares in Vanguard’s latest annual index chart above.

Having a diversified mix of investments across multiple asset classes can help smooth out returns over time. The table also reinforces the importance of sticking to an investment strategy and focusing on the long term. For example, the declining returns from international shares (hedged) in the 2016 financial year may have swayed investors to move out of this asset class in search of better returns elsewhere. In taking this option, investors would then have missed out on the 18.9% return in the 2017 financial year.

That given, history has shown us, our focus for investors are best served by broad diversification for long-term investment.

Contact Us with your Investments Shares goals and or enquiries

Do You Have A ‘Whole Wealth’ Strategy?

Our primary goal at FMG ‘Whole Wealth’ Strategists, is to empower you to build your own dream life. To recognize all the things that are most important to you. Without formalizing a blueprint your life and finances are just swaying in the breeze, being blown from one idea and whim to the next. Having a focused and well thought out plan is the start of you new reality.

This is tailored advice unique to your individual situation, to assist you to stick to your strategy but to also make adjustments as change arises in your life. It is also to help you manage your investments, and give up to date advice on your ‘whole’ financial projection.

We are also here to protect you against unnecessary risk, and generally we ‘watch over’ your finances. A good plan will work to bring everything together to make sure all your goals are securely covered.

Remember: Not everyone is the same and we all have different life goals.

Someone who’s a PAYG and just started investing will need different support compared to.. a significantly more complex scenario with a $2,000,000 portfolio, but no matter who you are, all dreams and goals are equally important. A surgeon or medical professional compared to a small – medium or large sized business, and professional investor or developer – people with several trusts will all have unique goals and all need an advanced and different level of support.

We work together and ultimately will be working for YOU on your ultimate goal plan.

Contact Us

If you need help with the right wealth plan, money and tax management strategies, and a support team or if this article has inspired you to take decisive action now, contact us and allow us to assist you on your wealth building journey.

We want you to make the rest of your life the best of your life.

<= SHARE THIS STORY

#investmentsshares, #investments #fmgwealthstrategists, #financialplanning, #moneytips, #moneymanagement, #wealthmanagement, #financialfreedom, #investing, #passiveincome, #shares

Disclaimer: This article is factual information only. It is not intended to imply any recommendation about any financial product(s) or to constitute tax advice. The information in the article is reliable at the time of distribution, but may not be complete or accurate in the future. For information about a loan that may be suitable for you, call us on 7111 0022.