Advanced Financial Strategies for Business Owners, Entrepreneurs and busy Professionals

People who are prepared to take ownership of their future. People who set and achieve goals around life, wealth and their highest values.

Are you asking yourself the following questions about your financial future?

- How do I start investing?

- What should I be investing in?

- What can I do to top up my super?

- Do I have enough Superannuation?

- Will I have enough money to retire on?

- What can I leave my children when I am gone?

- Are there better things I could be doing with my money?

- Will I have to work past retirement age to fund my lifestyle?

- What is the best way to structure my inheritance for my kids?

- I don’t have a huge nest egg, what are my investment options?

- I’ve come into an inheritance, what should I do with the money?

- Where should I allocate money for best growth for me and my life & wealth objectives?

These are common worries of people in the workforce today. You are likely to live longer and need to fund your retirement for more years than ever before. Not only that, if you want to enjoy travel, live where you want, have someone to mow your lawns and a nice car to drive, building wealth becomes even more important.

Building Wealth

Protecting your Wealth

Cashflow and Debt

Business Owners

PREVIEW EDITION

Who do we work well with?

Great question.

Our mission

To “Assist and Empower” committed wealth builders, entrepreneurs, busy professionals and ambitious business owners in Building and Protecting their Wealth.

We take a somewhat different approach

When it comes to building wealth for financial freedom, we look at both financial and non-financial aspects. We believe a balanced perspective is the key to success in ALL areas of your life. Wealth building is ONE part. Mindset is another. And of course, health and happiness is most certainly included!

Our ideal clients

Astute wealth builders, entrepreneurs, busy brofessionals and ambitious business owners who are open to learning and investing time into the implementation of a plan, being clear on your dreams and goals, and prepared to invest in yourself and your future passive income, to be financially independent as well as developing a powerful financial mindset.

We are not into whims

When it comes to wealth building, we love working with people who have a long-term view of building wealth and who know that consistency over time beats jumping onto the latest bandwagon every time. But, be assured when the right bandwagon comes along, we’ll get you on it!

Building true wealth and becoming Financially Free is innately everyone’s desire. This is our service to you.

How we build your financial future

Too many people rely on their superannuation fund to do the heavy lifting for them when it comes to creating their retirement income. Don’t get me wrong, super funds have their place but they should not be the only savings vehicle that you rely on to build your wealth.

Why not?

Well, for one, there is a contribution limit based on your annual salary that applies to superannuation. This means, even if you have the money to invest and want to, you are limited in what you can put into super.

Secondly, if your approach was to max out your superannuation early in your career, possibly because of the lower tax rates or “it’s the easy way to invest” attitude, you will find that your funds are locked away until retirement. This means that your ability to take on other investments or to liquidate your superannuation funds is virtually impossible.

What we recommend is that your investment strategy reflects your different life stages while still being as flexible as you need on a day-to-day basis.

How do we acheive this for you?

We work with financially independent individuals, established business owners and ambitious professionals to grow their wealth in a systematic and sustainable way. Our focus is results, based on your financial goals, a top range plan with financial security, getting it right the first time around, with some fun along the way.

Looking after our clients, taking care of the details and helping to you make informed decisions as well as saving you money where we can, is our strategy. We use a combination of education, strategic planning and mindset to construct an investment program that suits both your risk profile, personal circumstances and long-term goals.

We know you’re busy

So we streamline the process as much as possible. You are asked a series of questions that give us a clear understanding of your risk tolerance levels, your current financial situation, your highest values, your future goals and your experience with different asset classes (shares, property, etc).

From here, you give us the go ahead and we prepare a detailed report showing how you are able to achieve your financial goals, the commitment required to achieve this as well as establish where to focus your attention and map out the highest priority actions. This will let you know how much income you are currently on target to have in retirement along with.

Financial Modelling

We do this to show the long-term position your current retirement savings plan will leave you in at retirement age. We then do a sensitivity analysis to show how different the results could be when we apply our holistic approach to wealth creation.

What’s important here is that we take the time to educate ourselves on your goals for the future. It is this personal financial advice that makes the difference to your financial future.

The end result is a financial future that allows for :

- A retirement that is free from financial worries

- A retirement nest egg that lasts beyond you needing it

- A legacy for your children

That’s not where we stop however.

Your portfolio is constantly monitored to adjust to the changing circumstances that life throws at you.

- Want to increase your regular income stream in retirement so you have more spending money? We run the figures to show how this will affect your portfolio.

- Want a lump sum withdrawal for some reason (children’s wedding, home renovation)? We factor this into your financial plan and let you know the consequences for your retirement lifestyle.

Start Early

If you start early enough then you can appreciate the miracle of compound interest. The holy grail of investing is to have your investments provide you with an ongoing income that is sufficient to fund your lifestyle without having to work again. Imagine being able to leave wealth that transcends generations so that even your children’s grandchildren can benefit!

What asset classes do we deal with?

The saying is “don’t put all your eggs into one basket” and that’s our approach too. We deal with a full suite of investment options and can offer professional advice in all of the following asset classes:

- Superannuation

- Investment Property

- Financial Markets

- Stocks

- Life and other Personal Insurances

- Business Protection Insurances

- Succession Planning

- Estate Planning

What this means for you is, even if you’re not a sophisticated investor, your savings portfolio will look like you are!

Long-Term Financial Planning

One of the great unknowns is Life expectancy. If you knew exactly how long you had it would be easier to plan for the future but we don’t. That’s why investment assets that offer financial security and an ongoing annual income form one of the pillars of your financial plan. Using the income generated from investments to further build your wealth in a virtuous cycle.

Estate Planning

Speaking of leaving things for your children, we look at the tax implications of your investments and your estate planning. Our aim is to ensure the most tax effective handover of your estate when the time comes.

When you’ve worked hard to build wealth, it is important that you retain as much of it as possible so that your children can also benefit.

Latest Blogs

5 Questions to ask when investing

Staying the course when it comes to investing isn’t easy for investors, especially when there are always market ups and downs and when there’s...

Tax effective education bonds

Tax effective education bonds are a good purpose built financial investment strategy that pays for your child's or grandchild's education. Why...

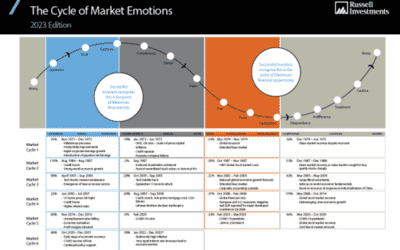

Understanding the Cycle of Emotions through economic and financial stress.

The theory behind the Cycle of Emotions chart demonstrates the opportunities and threats that result from economic and financial stress in your...

Get ONE Quality Tip Each Week

- Powerful Tips on Building Wealth

- Easy Wealth Protection Strategies

- Planning for Your Retirement PLUS more

Something that makes a difference in your life and building your wealth.

We won't send spam. Unsubscribe at any time.