Are you getting a Tax refund?

💰 If you are getting a tax refund, here’s how to spend it in a way that will change your life!

Did you know that the average Aussie gets a tax refund of around $2,500. Even better, this year the Low And Middle Income Offset of up to $1,080 kicks in. Those earning between $48,000 to $90,000 are in the sweet spot. So, how will you spend a grand or so from the taxman?

Here’s three ways getting a tax refund can change your life.

1. Savings Account Injection

When getting a tax refund, remember our saving’s rule.. having a cash backup balances the volatility of emotions when it comes to our finances. The more you have in this account the more confident you become and the way you handle money changes. You are more empowered and emotionally stable around your financial situation.

So, when getting a tax refund, save your refund into your savings account. Cash is the ultimate emergency back-up. Then, with your cash behind you, you can go ahead and confidently choose what you do after that.

That’s one way that will change your life when getting a tax refund.

P.S. Maybe cutting up your credit card and start paying that ‘sucker’ (or suckers) off. Escaping the credit card merry-go-round is definitely another bonus way that will change your life.

2. Protect yourself (and your love ones)

Sitting down after getting a tax refund with an estate planning lawyer and drawing up a will, will help you navigate the ‘death taxes’ that is inevitable for all of us: capital gains tax, stamp duty, and income tax. And also, for those with adult non-dependent children, a 32% tax slug on your super.

Perhaps a testamentary trust would also be a good investment. Plus enduring power of attorney and medical power of attorney would be wise.

No matter what age, death and taxes are certainties in life: So after getting a tax refund, why not protect your loved ones after your untimely demise from the ever increasingly, greedy tax man.

That’s another way, when getting a tax refund that will change your life. Getting this sorted is the best and final way you say ‘I love you’ to the people you love the most.

3. Invest for the long term

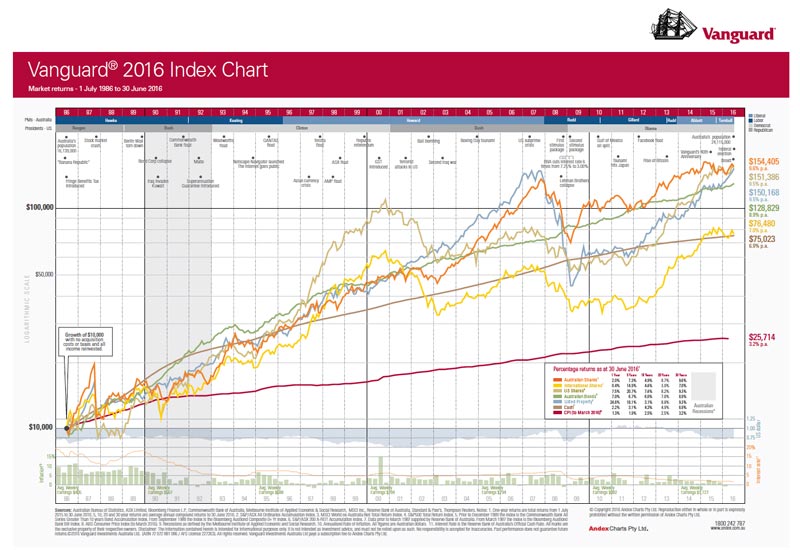

After getting a tax refund, having a roadmap for long-term wealth through investing is important, and the best way I can serve you is by working hard to find you the best possible investments that fit with your goals and financial objectives.

If you’ve got an idea of starting an investment portfolio, use your tax refund money to kick-start it once and for all. Or, want to review what you have, using your refund money is a good way to reassess and invest in what is best for you right now and moving forward.

These days you don’t need to put in much more than a couple of grand to get started: after getting a tax refund, starting with a good plan is your first step. And earning money and compounding along the way is another way that will change your life. You can read our post about successful investing here

Getting a tax refund? Final idea!

Investing in yourself through financial education. A plug so blatant that Warren Buffett would be even proud! Earlier this year I released the 2nd edition of my book The Art of Building Wealth: A great coffee table book to read (and then pick up and put down), packed with time proven Hints, Tips and Wealth Strategies to implement that have been used by many, many investors and entrepreneurs to change their financial lives!

Grab a copy here

Need Help?

We can help you sort out your future plan, get you clear on your financial and lifestyle goals and also give you unbiased personalized wealth and retirement planning advice that lays out your options without the hard sell.

And if you are new to us, your first ‘discovery’ meeting with us is fee-free and obligation-free. Thereafter we charge you an hourly or fixed fee, just like your plumber does. Or, become and ongoing client and get way more value for money! It rocks. 💰📈

So, if you need help setting up and maximizing your ‘Wealth Strategy’… call us on 7111 0022 and arrange a face-to-face meeting with us, or book a chat with me here.

Arthur Panagis

Author, Founder, Wealth Coach and Financial Strategist

B.Bus (Accountant)

Grad Dip (Financial Planning)

Professional Certificate in Self Managed Super Funds

ASX Listed Equities Accreditation

Tax (financial) Advisor

This article is prepared based on general information. It does not take into account individual financial objectives or needs and is not financial product advice.

SHARE THIS ARTICLE