Discover our #1 Hack for Increased Savings

If you have an ongoing payment say, for a car or are extinguishing a credit card debt or a similar scenario, the moment the debt is paid off put that exact amount into your savings.

If you don’t, either your income will drop or your expenses will increase to match that amount of money.

Since you were able to make the payment before – it’s no hardship, and instead of loss of income or inviting increased expenses you can turn it into an increased savings.

Listen to this quick audio that explains the principle of this money magnet tip – click on the soundcloud link below to listen 💪💰

This is our #1 Hack for Reducing credit card DEBT faster

– and turning those payments into increased savings.

I wanted to showcase a situation where increased savings are achieved by reducing debts more quickly with the flexibility of a loan to consolidate your debt can help in lots of situations.

💰 Because we want you to get GOOD with money 💰

This could be you or someone you know..

Example client profile

• Owes $37,000 across multiple credit cards at 19.99% p.a.

• Pays annual fees totaling $385 on their credit cards

• Has an Equifax score between 601-700

• Can afford to repay a max of $1,000/month

The client wants to consolidate their credit cards to reduce their monthly expenses, and reduce their liabilities to put them in a better position to in the near future. They may want to purchase property for example, and are preparing for that.

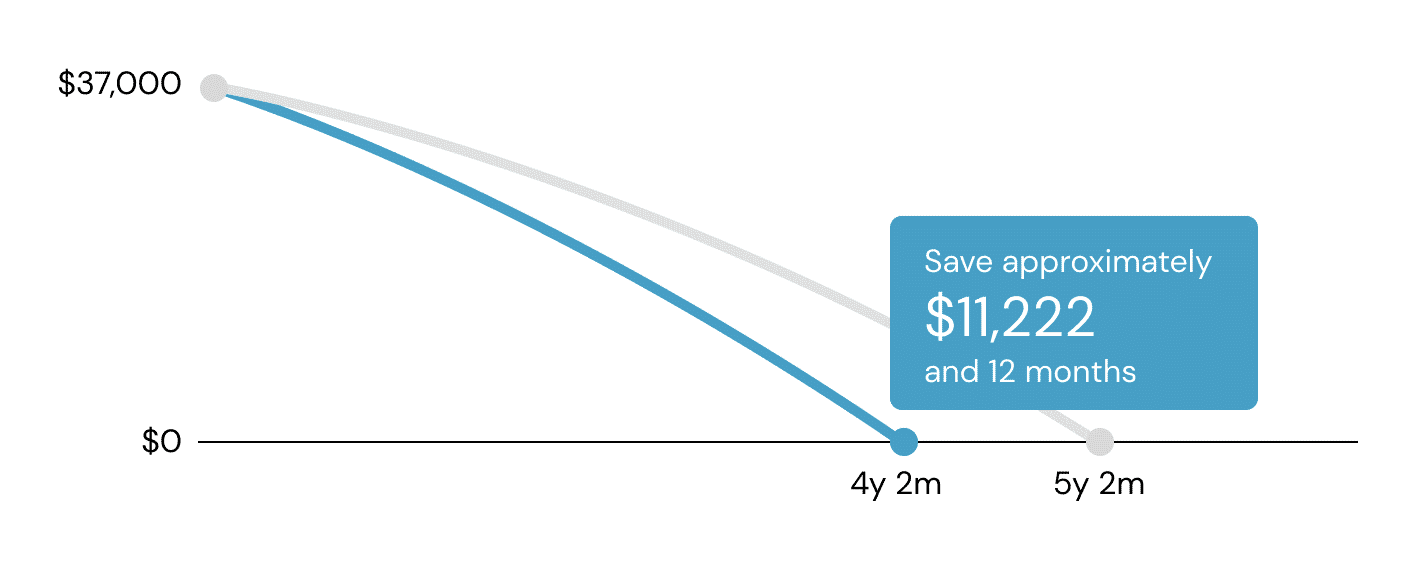

If the client pays $1,000/month toward their credit cards, it will take them approximately 5 years and 2 months to pay off. The interest paid over that time would total over $22,000. 😯

The solution

A consolidation loan could offer the client a 7-year, $37,000 unsecured loan at 10.99% p.a. The minimum monthly repayment would be $682.

– If the client puts $1,000 towards this loan each month, they will be able to pay the loan out in 4 years and 2 months and save over $11,000 in interest. Halving the interest that would have been paid! 👊

Credit card

Credit Card debt $37,000

Interest rate 19.99%

Total fees $1,925

Interest paid – – a whopping $22,089!

Time to repay 5y 2m

Total payments $61,014

Loan option 💪

Personal loan $37,000

Interest rate 10.99%

Total fees $2,840

Interest paid $9,952 – – huge savings!

Time to repay 4y 2m

Total payments $49,792

Time and money well spent.. (saved actually, and then can continue these savings and allocate them to an investment that will have your money work for you!!) 💪

Remember my money magnet tip: Increased savings.

Who am I?

As a husband, business owner and father I completely understand the struggles and stress of having a home loan, paying off credit cards, car loans and trying to provide a great life for the family and kids.

I’ve dedicated all my adult years of my life to serving people, and passing on all my vast knowledge from years of study, learning from the masters, some trial and error, and have developed a unique strategy that is simple, systematic and can be tailored exactly for you – no matter where you are in your journey, or what your dreams and desires are.

Let me show you how increased savings will help to eliminate the stress, turn your money world around and join the growing number of everyday people who are day by day, growing their money and creating a life of freedom and incredible choice for themselves and their family.

Work with me to…

MASTER YOUR MONEY

PROSPER WITH PROPERTY

TAX EFFECTIVE INVESTING

PROTECTING YOUR WEALTH

FOCUS ON YOUR FUTURE

RETIREMENT PLANNING

– – all that sustainably builds your wealth and makes you smile year after year while boosting your retirement and lifestyle goals!

🎓 If you need help getting clear on your best strategy, planning your best financial life, call us on 08 7111 0022 or book a chat to see how we can best help you here

Arthur Panagis

Author, Founder, Wealth Coach and Financial Strategist

B.Bus (Accountant)

Grad Dip (Financial Planning)

Professional Certificate in Self Managed Super Funds

ASX Listed Equities Accreditation

Tax (financial) Advisor

REMEMBER, action is power!

💪 We want to make the rest of your life the best of your life.

– Head Office –

Suite 2, Level 1, 148 Greenhill Rd,

PARKSIDE SA 5063

Ph – 08 7111 0022

Email – info@fmgws.com.au

P.S. You could also read our Guide to Successful Investing here. *Preparation is the key to any success! 💪

<= SHARE THIS STORY

Disclaimer: This article is factual information only. It is not intended to imply any recommendation about any financial product(s) or to constitute tax advice. The information in the article is reliable at the time of distribution, but may not be complete or accurate in the future.