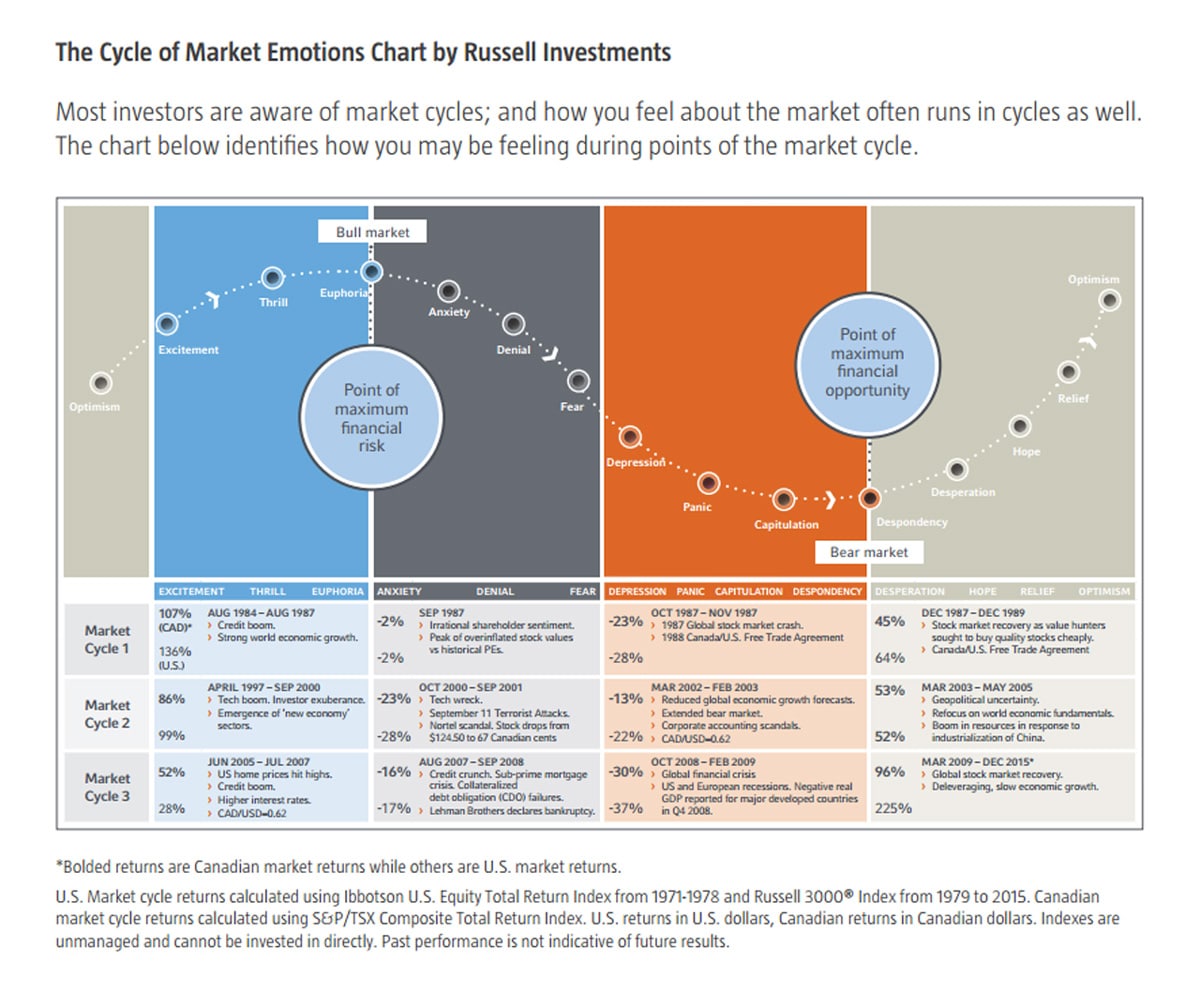

Most investors are aware of the cycle of market emotions that they feel as the markets run through their cycles. Action and non action can have a big effect on your long term wealth.

Understanding the cycle of market emotions

Most people know of Warren Buffett’s famous quote, “Those who cannot manage their emotions won’t be able to manage money”.

So, let’s start at the start.

Everyone has a story about money… consciously or unconsciously the results in your life and the balance of your bank account always tell the truth.

In the beginning, as an infant you hadn’t yet developed your mind, so everything went in. Your mind had no ability to discern or reject. It’s that information that went in that built your belief systems and paradigms. This is especially powerful when it comes to how you think and feel about money.

The sub-conscious mind constantly watches, stores and records all events and experiences, and over time it has created stories about them. Your belief systems are all built from when we are young and without your interception, that’s how you unconsciously become who you are.

So, as your thoughts and belief systems manifest the results in your life, they all have an effect on your finances, relationships, health, career, what you believe, how you act or react, the events and experiences you manifest in your life.

In short, your conscious or unconscious emotions around money determines the size of your bank account and your ability to build true wealth. And, understanding the Cycle of Market Emotions will help you build long term wealth.

Once you understand this and keep your emotions in check, you have the ability to change your finances and build your wealth accordingly.

So, let’s take a look at the chart to understand the cycle of market emotions that we go through as investors.

Historical data going back for decades shows that despite inevitable short-term price dips, asset classes perform differently from year to year, but, over the long term you can expect each asset class will deliver growth. So, understanding the cycle of market emotions helps you build long term wealth.

The value of creating a built to last investment plan

That’s where creating a built to last investment plan to future proof your finances and investing across a range of asset classes, including later during your pension drawdown retirement phase, will help smooth out poorer returns from other asset classes from year to year.

If having more money to invest and enjoy your retirement with passive income is important to you, the best approach is to build an investment portfolio that will help protect your retirement capital. If you need help to plan and build a well-diversified portfolio that can offset the risks of being too exposed to and to live well in retirement, contact us here.

REMEMBER, action is power!

We want you to make the rest of your life the best of your life.

Arthur Panagis

Author, Founder, Wealth Coach and Financial Strategist

B.Bus (Accountant)

Grad Dip (Financial Planning)

Professional Certificate in Self Managed Super Funds

ASX Listed Equities Accreditation

Tax (financial) Advisor